Professional Tax Relief Services in Memphis and nationwide

Regain Financial Stability with Expert IRS Resolution

When tax debt becomes overwhelming, you need experienced professionals who understand how to navigate IRS communication and negotiate favorable outcomes for in Memphis and nationwide. Our tax relief services help you resolve back-tax issues through proven resolution tools and personalized strategies designed for your unique financial situation.

We serve the Memphis metro and surrounding communities, addressing local concerns for homeowners and small business owners affected by past financial hardships.

Our clear, confidential process helps clients throughout Memphis, Southaven, Germantown, Collierville, Bartlett, and Olive Branch regain control of their financial future through strategic IRS negotiation and comprehensive relief programs. We also can help clients remotely nationwide.

Call today to discuss your tax relief options confidentially in Memphis.

How Does Tax Relief Work in Memphis and nationwide?

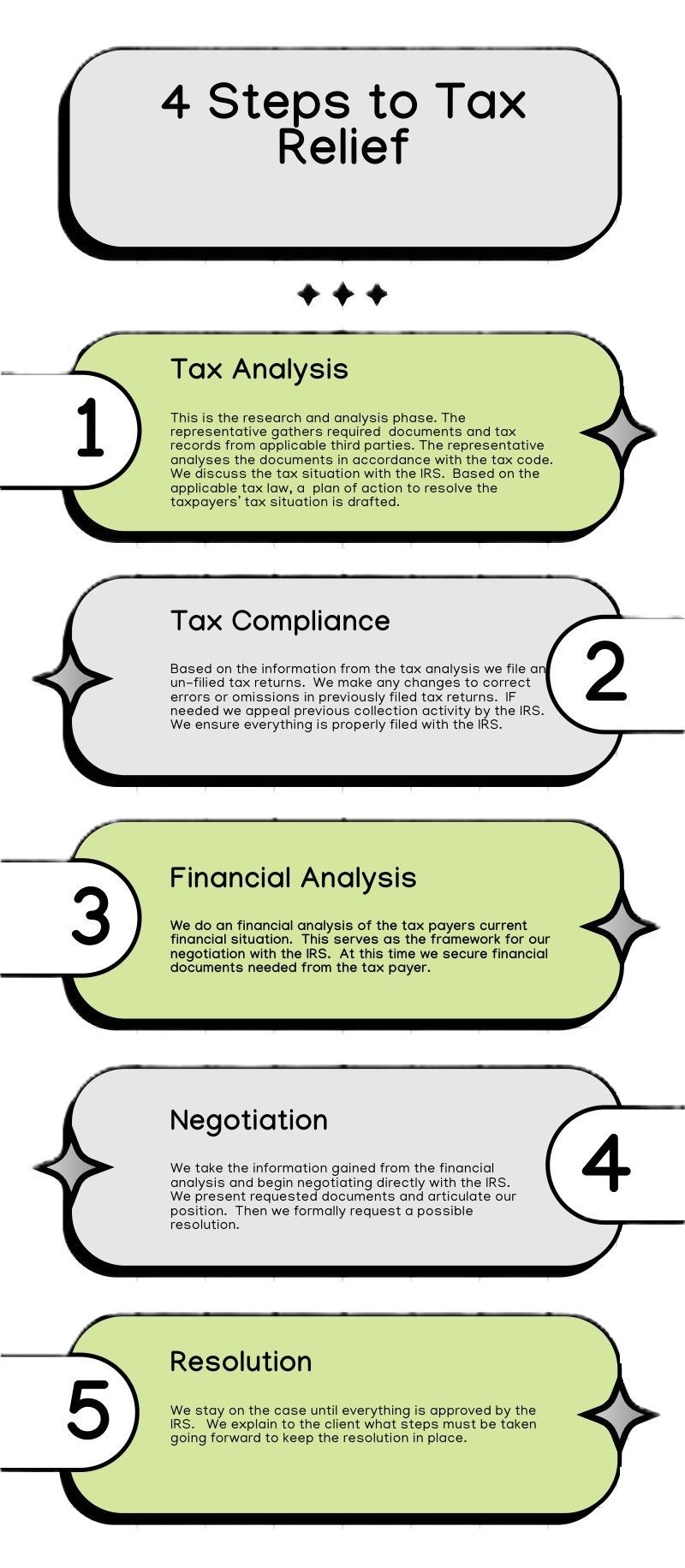

Our tax relief process begins with a thorough assessment of your tax situation, followed by direct communication with the IRS on your behalf to reduce the stress and complexity of resolving your debt. We use proven IRS resolution tools like payment plans and offer-in-compromise to negotiate the best possible outcome for your circumstances.

Throughout the process, you can expect regular updates and transparent communication about your case progress, while our experienced professionals handle all IRS correspondence and documentation requirements. This confidential approach helps clients regain financial stability without the overwhelming burden of navigating complex tax regulations alone.

We address each case with personalized attention, understanding that Memphis-area residents face unique financial challenges, from seasonal employment fluctuations to small business cash flow issues that can impact tax obligations.

Schedule your confidential consultation today for professional IRS tax debt help in Memphis and nationwide.

Fresh Start Tax Program

The IRS Fresh Start program is a set of initiatives designed to help taxpayers struggling with tax debt, offering options such as expanded installment agreements and Offers in Compromise (OIC) to settle for less than the full amount owed. The IRS offers these programs to help taxpayers resolve their tax situations when full payment would cause a financial hardship.

Many of these programs allow taxpayers to settle with the IRS without paying the full tax debt. For example, a taxpayer with a $100,000 balance might be able to have the IRS accept $50,000 and write off the remaining $50,000, depending on their specific circumstances.

Conversely, if a taxpayer does nothing, they could be subject to aggressive collection actions, including federal tax liens, levies, wage garnishments, or seizures. The IRS is permitted to use these measures to collect unpaid taxes when a taxpayer has not entered into a resolution agreement. Click here to learn more about IRS enforced collection actions.

Key Features:

Partial Pay Installment Agreement (PPIA)

Currently Non Collectible (CNC)

What Makes Our Tax Relief Different

Our experienced professionals specialize in helping Memphis residents and remote clients resolve tax debt through strategic negotiation and comprehensive relief programs.

- How do we reduce your stress? We handle all IRS communication directly, removing the burden of complex correspondence from your daily life.

- What tools do we use? Our team leverages proven IRS resolution methods including payment plans and offer-in-compromise programs to achieve optimal outcomes.

- Why choose local expertise? We understand the specific financial challenges facing Memphis metro residents, from Southaven to Cordova.

- What's our process approach? Every case receives a clear, confidential evaluation designed to identify the most effective path to resolving tax debt.

- How do we serve diverse needs? We assist both individual and small business taxpayers affected by past tax debt throughout the greater Memphis area and nationwide.

Take the first step toward resolving your tax debt with confidence. Contact Top’s Noble Tax Services today to schedule your tax relief consultation in Memphis or remotely online.

Frequently Asked Questions

Is the irs fresh start program legitimate?

Yes, the fresh start program is legitimate. Not every taxpayer qualifies.

What is the irs fresh start program?

The IRS Fresh Start Program is a legitimate IRS initiative designed to help struggling individuals and businesses manage outstanding tax debt.

How do I qualify for the IRS fresh start program?

First file all past returns, then complete the collection information statement (CIS)

Which tax resolution is best for me?

It depends on the results of your tax analysis.

How do I know if I qualify?

You can purchase a tax analysis. Our tax analysis will let you know if you qualify and whilch resolution is best for you.

How long does it take to get approved for an OIC

It depends of the taxpayers situation. It typically takes 6-12 months.