Professional IRS Notice Help in Memphis and nationwide

Navigate IRS Correspondence with Expert Guidance

Receiving an IRS letter or audit notice creates immediate stress, especially when you're unclear about how to respond or suspect your previous tax preparer made errors. You need experienced professionals who understand IRS procedures and can protect you from escalating penalties.

Our experienced tax professionals ensure all IRS deadlines and requirements are met while providing clear, supportive communication through every stage.

We specialize in notices for underreporting, missing returns, and verification requests, serving individuals and business owners throughout the Memphis metro area and nearby suburbs.

Call today for immediate assistance with your IRS correspondence in Memphis and nationwide.

Common IRS Letters:

CP 2566 Notice

The CP 2566 informs the taxpayer that the Internal Revenue Service (IRS) has not received their taxes for a particular year. The IRS then prepares the taxes for the taxpayer and sends them the tax bill. Taxpayers receiving a CP 2566 notice are taxed at the highest tax rate and; the IRS will omit credits and deductions even if the taxpayer qualifies.

CP 11 Notice

If there is an error on taxes submitted for a taxpayer, a letter is sent to the taxpayer explaining the error and how to correct it. In certain situations, the IRS will make the adjustment for the taxpayer. The CP 11 notice informs the taxpayer that the Internal Revenue Service (IRS) made adjustments to their taxes. These adjustments caused the taxpayer to have a balance, or increase their balance with the IRS. The IRS calls this a math error. A math error is a miscalculation of the taxes. One miscalculation can affect another area of the tax filing. For example, a miscalculation of deductions can affect taxable income which could then affect the non-refundable credits. The rules for math error notices differ from other proposed balance due notices. Math error procedures are exclusive to math error notices.

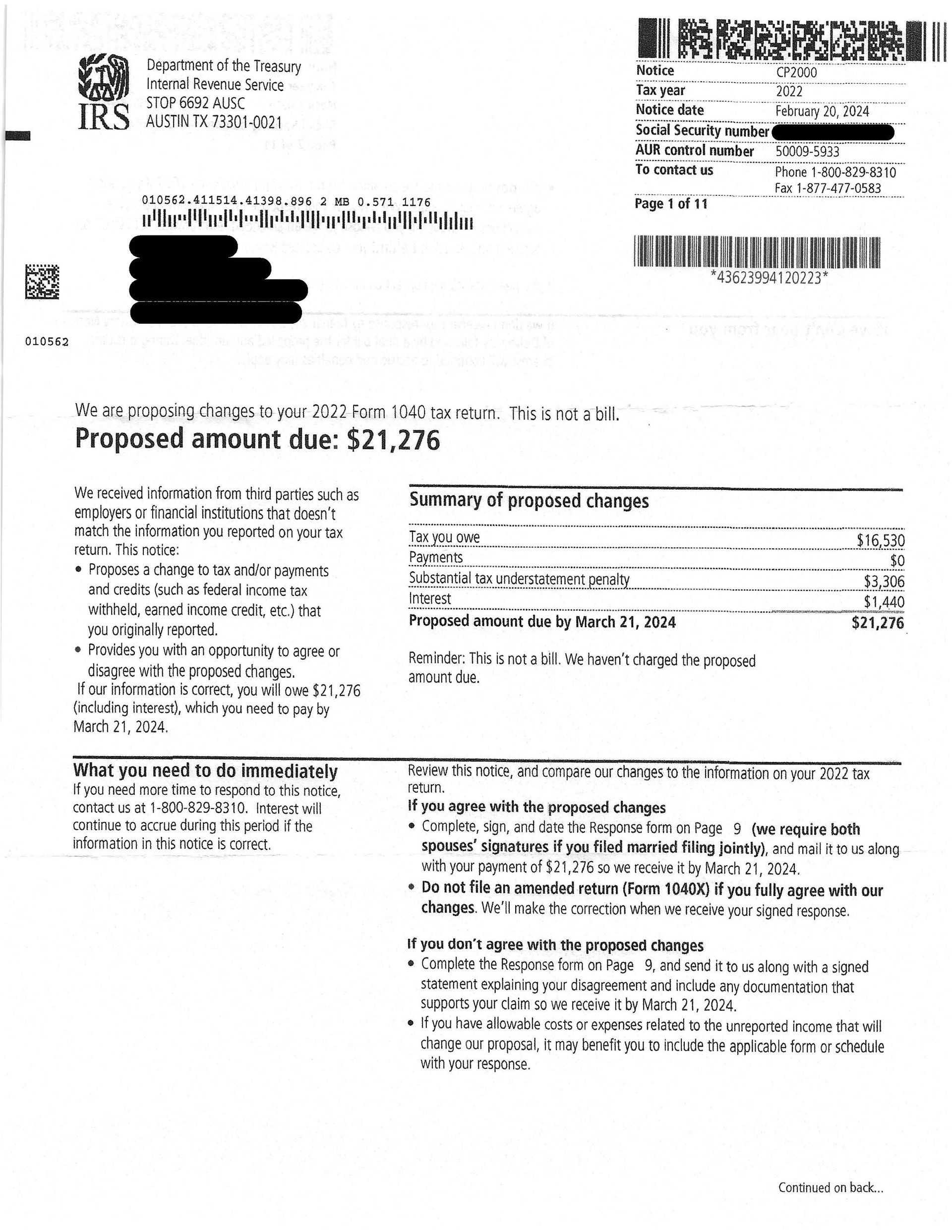

CP 2000 Notice

Business, or third parties are required to report taxpayers' income on Forms W2's, 1099's and other information returns. These information returns are filed with the Internal Revenue Service (IRS). The IRS compares the income reported by third parties to the income taxpayer's report when filing taxes. When the taxpayer's income is less than the income reported for them by third parties, this is called underreported income.

Automated Under Reporting (AUR) is a department within the Internal Revenue Service (IRS) whose only job is to find underreported income. When AUR finds underreported income, they recalculate the taxes with the unreported income. These proposed changes are sent to taxpayers in a CP 2000 notice. These changes can result in large balances for taxpayers. In addition, the IRS can propose a 20% penalty. The Accuracy Related Penalty allows a minimum penalty of 20% for, what the IRS calls, "substantial understatement of tax" or negligent disregard of the tax rules.

Why Choose Professional IRS Notice Response in Memphis and nationwide?

IRS notices require precise responses within specific timeframes, and errors in your reply can trigger additional penalties or more intensive audits. Our team interprets the exact requirements of your notice, whether it involves underreporting income, missing documentation, or verification requests that seem confusing or overwhelming.

We help clients who discover that tax returns they thought were filed actually weren't submitted, or who received error notices that indicate problems with their previous filing. Our systematic approach addresses each IRS concern methodically while building a complete response that satisfies their requirements.

When previous tax preparers made mistakes or failed to file returns properly, we step in to correct the situation and restore your good standing with the IRS through accurate documentation and professional correspondence.

Schedule your consultation today for expert IRS audit response in Memphis and online.

Memphis IRS Notice Response Advantages

Our Memphis-based team understands the local business environment and individual tax situations that commonly trigger IRS inquiries.

- Why choose local Memphis experts? Understanding of Tennessee tax structures and common issues affecting residents in Germantown, Bartlett, and Collierville

- What experience do we have? Extensive background interpreting and responding to various IRS letters, audits, and verification requests

- How do we ensure compliance? Systematic review of each notice requirement with responses that fully address IRS concerns and prevent escalation

- What sets our service apart? Clear, supportive communication that eliminates confusion and guides you confidently through the IRS process

- How do we serve Memphis specifically? Local accessibility for in-person consultations combined with deep knowledge of regional tax complexities

Avoid escalating penalties and unnecessary stress with professional IRS notice response.

Contact Top’s Noble Tax Services today to schedule your consultation and ensure your IRS correspondence is handled correctly in Memphis.