Tax Resolution Services

We provide a wide range of professional services to meet your needs. We promise to provide every service with a smile, and to your highest level of satisfaction.

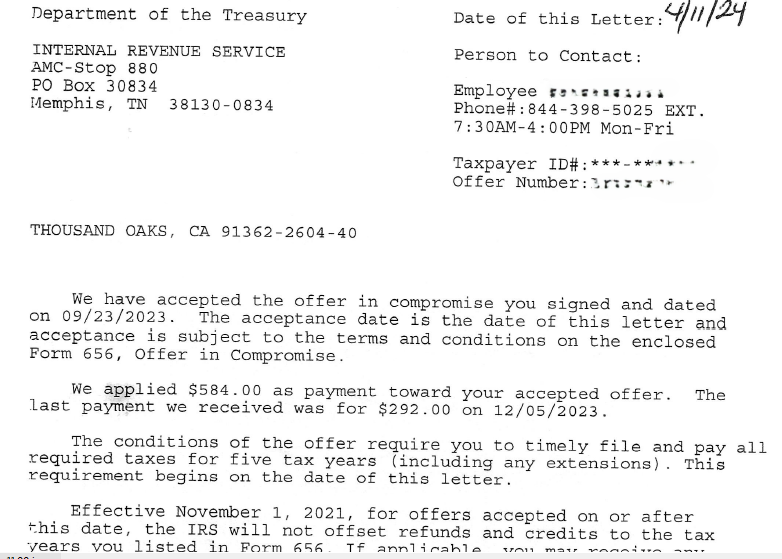

Offer in Compromise (OIC)

An IRS Offer in Compromise (OIC) allows taxpayers to settle tax debt for less than the full amount owed when paying in full causes financial hardship or is unlikely.

Key Features:

- Stops Aggressive Collection Activity

- Taxpayer not locked into monthly payments

- IRS closely monitors terms of the accepted offer

- Tax debt can come back if taxpayer violates terms of the agreement

- Taxpayer must undergo detailed financial analysis

Partial Pay Installment Agreement (PPIA)

The Partial Pay Installment Agreement allows qualified tax payers to pay a reduced monthly payment. If the tax payer continues to make payments on time at the end of the agreement the IRS waives the remaining taxes; allowing tax payers to settle their tax debt for pennies on the dollar.

Key Features:

- Stops IRS aggresive collection activity

- Requires a financial analysis

- Less negotiation time

- Must file and pay future taxes timely

Currently Non Collectible

Currently Non Collectible allows qualified taxpayers to suspend collection activitiy. While in Currently Non Collectible status the taxpayer does not have to make payment on the taxes.

Key Features:

- Requires financial analysis

- Stops IRS aggressive collection activity

- Must file and pay future taxes timely

Frequently Asked Questions

How to get an offer in compromise approved

It's best to hire a licensed Enrolled Agent with the IRS who has experience negotiating with the IRS. Provide the requested documentation.

How much should I offer in compromise to the IRS?

Every case is different. The offer amount depends on your tax analysis and financial analysis.

What happeneds if I file taxes late?

All tax must be filed before any resolution is established. We will file any unfiled taxes. The IRS will assess a penalty for late taxes.

Can you have two payment plans with the IRS?

No, you can only have one payment plan with the IRS.

How much interest does the IRS charge for payment plan

The interest rate is adjusted quarterly, and compounded daily. Interest will accrue on any unpaid tax, penalties and interest until the balance is paid in full. The IRS uses the federal short-term rate based on daily compounding interest to calculate the interest they charge and pay. Changes to the rate don't affect the interest rate charged for prior quarters or years.

Frequently Asked Questions

How to get an offer in compromise approved.

It's best to hire a licensed Enrolled Agent with experience negotiating with the IRS. Make sure everything is complete and proivde requested documentation.

Title or Question

Describe the item or answer the question so that site visitors who are interested get more information. You can emphasize this text with bullets, italics or bold, and add links.Title or Question

Describe the item or answer the question so that site visitors who are interested get more information. You can emphasize this text with bullets, italics or bold, and add links.